How Norwegian left thousands out of work

From "cost control" to "lost control"

Norwegian Air has the Irish government, the EU, major airports, airlines and businesses on its side

An intentionally convoluted business model – held in high esteem by European politicians – used to reduce cost, exploit regulatory loopholes, optimise taxes and keep crew at a distance, eventually served its purpose.

The low-cost long-haul airline Norwegian has laid off 90 per cent of its staff, leaving thousands out of work and many unable to get payments due. While the parent company is under restructuring proceedings in Ireland and Norway, European taxpayers, along with employees, shareholders, banks and states are likely to be served the bill of a failed management and regulators blind to a flawed business model.

A history of debt

Norwegian, the long-haul, low-cost airline, which many still associate with its ex-CEO and founder Bjorn Kjos, flirted with bankruptcy long before the COVID crisis struck.

After 17 years, I’ve decided to step down. I look forward to new challenges at Norwegian and welcome Geir Karlsen as acting CEO. I’m incredibly proud of what the team has achieved together so far at @Fly_Norwegian. Thank you to everyone at #FlyNorwegian and to all our passengers! pic.twitter.com/1eggJNvkOG

— Bjørn Kjos (@bjornkjos) July 11, 2019

Kjos was the driving force behind the airline’s breakneck expansion, which started around 2012. With the largest orders of aircraft in European history, bases in 11 countries and across 4 continents and almost 10.000 employees, the airline was booming.

By 2016, its shares surged nearly 400 per cent.

But then, investors became increasingly concerned about the company's cash flow and began questioning the rapid expansion strategy (Source: FT).

Adding to the mix, the Dreamliner engine problems shook the boat in 2018 and the airline found itself forced to scale back some of its long-haul routes. Not long after, the Boeing MAX brought another major financial hit to the airline, putting an end on its narrow body transatlantic flights.

But while the pandemic and the Boeing problems, could be attributed to bad luck, the over-aggressive, debt-fuelled expansion – are purely management decisions.

The massive scale-up philosophy was backed up by an equally overblown and complex company set up, allowing Norwegian to protect its assets, shuffle the risk, optimise taxes and cherry pick from Europe’s regulatory loopholes, while keeping employees at an arm’s length. From the beginning pilot associations were raising the alarm about this ‘new business model’ but decision-makers were blind to its flaws.

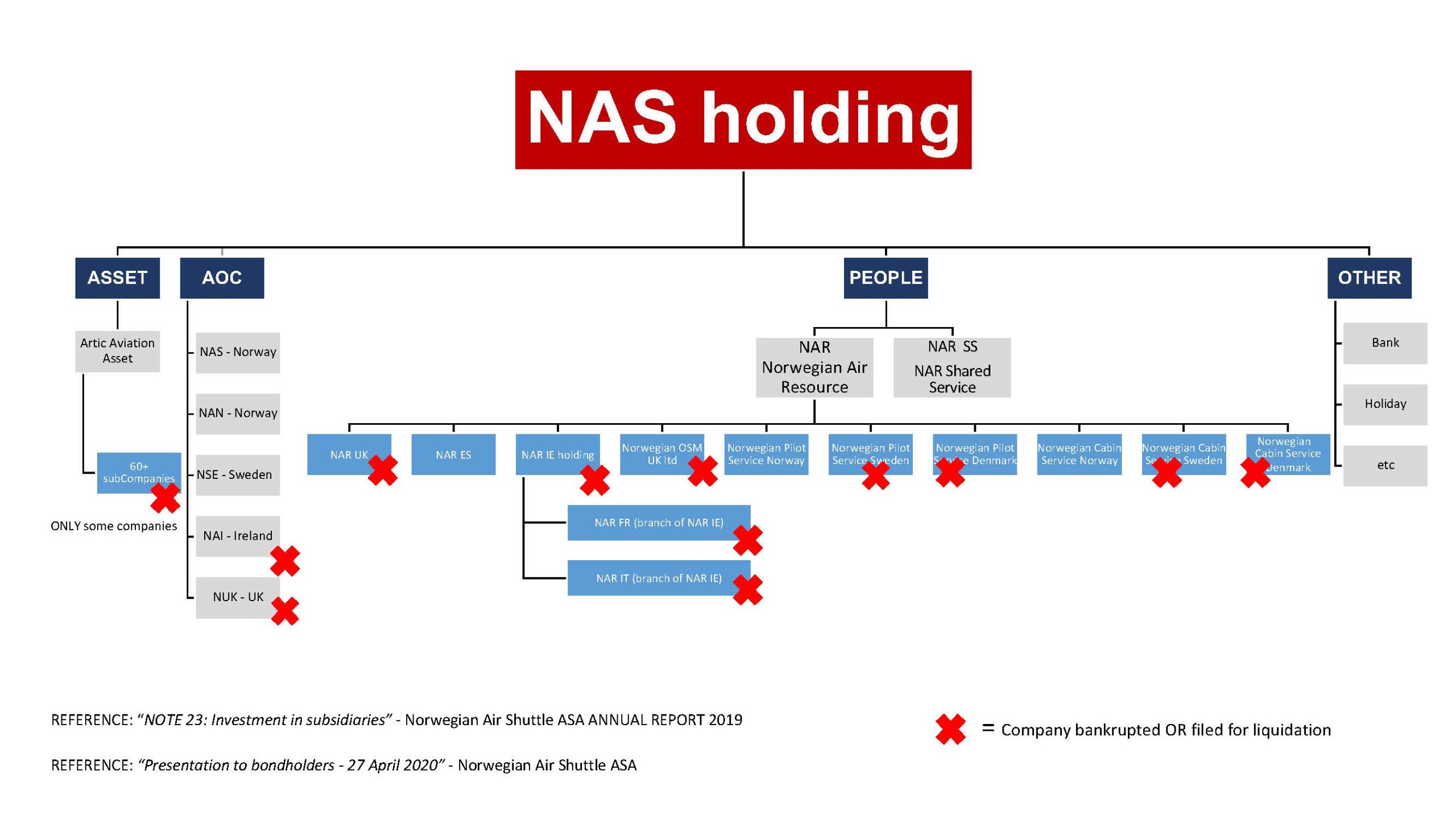

The structure – from 1 to 60

To understand how Norwegian evolved, 2013 is a milestone year. Before 2013 Norwegian operated as a regular airline with its business unit, Air Operator Certificate and crew under one entity. With the start of the expansion, Norwegian saw an opportunity for better cost control by using a different, more elaborate, corporate structure. The Norwegian group organised its airline activities under a parent company – Norwegian Air Shuttle – and its fully owned subsidiaries: one in Norway and one in Ireland. In addition, over the years it added subsidiaries in Argentina, UK and Sweden, and a US joint venture with OSM.

Norwegian Air International, based in Dublin and holding an Irish AOC, was initially set up as the main long-haul subsidiary operating Boeing 787 aircraft, also registered in Ireland.

Another branch under the Norwegian group, Arctic Aviation Assets, was charged with managing the planes, i.e. aircraft leases, financing and ownership. This included a group of subsidiaries based in Ireland.

Other legal entities such as cargo-handling services, holiday packages, its reward program and even its corporate brand, were all registered in various countries.

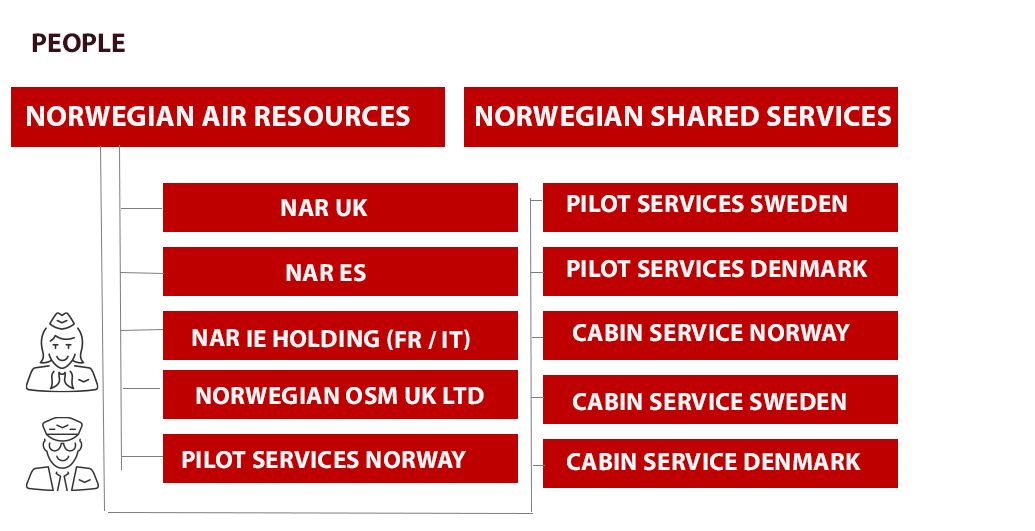

The people working for Norwegian, were separated in a different branch of the Group – Norwegian Air Resources. Various local subsidiaries were set up under this branch in countries across Europe.

The complex web of subsidiaries grew from 19 to over 60 in just five years’ time. The majority of those subsidiaries were – unsurprisingly – registered in Ireland.

Irish attraction

What makes Ireland so appealing to the Norwegian group? In the past decades Ireland built and reaffirmed its reputation as an aviation hub offering attractive aircraft leasing and financing conditions and favourable tax rates. All that, backed by aviation-friendly regulators, made the Emerald Isle appealing to airlines beyond Ryanair.

As a bonus, the flexibility in terms of traffic rights and employment conditions quickly drew Norwegian’s attention and became an important piece of Norwegian’s transatlantic operations puzzle.

The airline was counting on cheap labour hired from Thailand via a temporary work agency based in Singapore and the Irish long-haul subsidiary was a good fit for the experiment. That this ‘business model’ violates labor standards in the EU-US Open skies agreement was an inconvenient truth, which the EU Transport Commissioner at that time Violeta Bulc preferred to ignore. The Irish AOC’s main effects were to circumvent Norwegian labour law, to avoid paying any social charges in Norway or any EU country, and to circumvent Norwegian immigration rules. Only after firm protest from pilot groups on both sides of the Atlantic did the company abort this plan and pledge to use American & European-based pilots.

But it is clear that the Irish flag was a deliberate and far-reaching effort to minimize all possible costs. The Norwegian business model was keen on using loopholes and counted on a corporate structure with multiple subsidiaries, that would make it possible.

And what about the crew?

Once it started venturing outside of its homeland, Norwegian introduced temporary work agencies to crew its aircraft. During the expansion, it added an extra layer of complexity and set up a number of subsidiaries within the Norwegian group to carry out this task. Under the company name Norwegian Air Resources, the group built a web of subsidiaries that would recruit pilots and cabin crew for its operations.

While crew were offered a direct contract, which respected the local labour legislation, there was a concern among many. By hiring crew via a subsidiary, and not the airline, the Norwegian Group made a calculated attempt to keep them at an arm’s length. Not only did it make cross-border unionisation difficult but there was nothing preventing Norwegian from liquidating one subsidiary and hiring the same people via another one on lower terms and conditions or simply move crew between countries and between different terms and conditions for the same job.

With this threat hanging over their heads, the Norwegian association NPU and Parat took Norwegian to Court trying to convince judges of the obvious – that pilots and cabin crew are employed by the airline Norwegian, not by an artificially created crewing subsidiary. NPU and Parat didn’t succeed but a similar case is still ongoing in Spain. Ex-CEO Bjorn Kjos was happy to pose for a picture with Spanish pilots during negotiations with the union SEPLA, but refused to acknowledge being the employer of the thousands of crew working on the airline’s aircraft. In the meantime, the EU Court of Justice issued a Judgement where the user company is recognized as the real employer when agencies only deal with salaries.

Even in the case of France and Italy, where this subsidiary model was tiptoeing around the legal limits, Norwegian found a loophole. Those countries prohibit the use of staffing agencies to supply crew to just one company. Instead, Norwegian registered local branches under the Irish mother company to provide crews in Italy & France.

By keeping pilots in silos, Norwegian held a powerful card. In addition to the flexibility of easily cutting them lose in a jurisdiction if required, it could play them against each other, if needed during negotiations. It could also obstruct the information flow, easily sowing division and mistrust, while trying to reach the lowest common denominator of staffing costs.

However, Norwegian miscalculated the power of social media and messaging services, which were now well implemented among pilots. Norwegian pilots came together under the Norwegian Pilot Group (NPG), which despite the challenges of the structure, still found a way to exchange information, benchmark terms & conditions and set common goals for negotiations with management. With its strong identity, the NPG united Norwegian pilots all over Europe and gave them the drive to stand together for their collective working conditions. Local contracts linked to the Home Base, union engagement and a Master Seniority List were among the most notable achievements for pilots. While the NPG saw the risks associated with the corporate set up, they were also favouring a constructive approach that would help the company strive.

And this was welcome because Norwegian was already piling up debt. Against this background, the anecdotal HR hiccups with inaccurate payments to crew sound irrelevant. Payroll & crew control and rostering were outsourced to different entities, mostly in Ireland, and they did not communicate well with the other entities. Those inefficiencies were minor, but they were a sign of Norwegian not being entirely in control or cost-efficient.

Pilots recall how the Irish subsidiary – NAI – was not aligned with the rest of the structure. With a number of ex-Ryanair managers in NAI, pilots had a feeling, that NAI is charting its own course, independently from the parent company Norwegian. The Scandinavian people-centered managerial approach clashed with the Irish hard-handed style. The set up was showing some cracks.

The only thing missing in the picture was a global disaster.

Crew? No longer Norwegian’s concern

Fast-forward to 2020. Several months into the appointment of the new CEO, Jacob Schram, COVID struck.

With almost its entire fleet grounded and no cash reserves, Norwegian was struggling to survive. In November 2020, it entered into examinership in Ireland. A month later it secured bankruptcy protection in Norway too. At first, the Norwegian government refused to support financially Norwegian due to its complex structure and the absence of “shareholders seeking to take the initiative”. But after presenting a slimmed down version of the airline, focusing on Norway and the Nordic region, the government agreed to support the airline’s refinancing (Source: FlightGlobal)

At the same time, the company also quickly moved to chop off its crewing subsidiaries in Finland, Denmark, Sweden, UK, France and Italy. Thousands of pilots and cabin crew are no longer of Norwegian’s concern.

In the UK, the workers, who are owed wages, notice pay, holiday pay and pensions contributions, are now having to launch claims with the UK government’s Insolvency Service, according to Unite.

The union is also raising questions over £10.5 million gone missing. The money was supposed to be paid to Norwegian’s UK subsidiary – NAR UK – by another part of the Norwegian Group but was never received.

But with the majority of subsidiaries based in Ireland and 140 aircraft held by companies based there, Ireland is the country to watch. In public statements Norwegian says its "top priority" will be safeguarding as many jobs as possible while it restructures its asset base. The reality is, that as it entered into examinership, the EU legislation protecting workers in the event of bankruptcy was bypassed. Employees completely fell off the radar.

French pilots, who were employed by the Irish subsidiary, can now only watch the Irish Court proceedings from the sidelines, without tools to enforce or obtain what they are owed.

Indeed, we learnt of the decision to close the Paris base, by a general email to employees on January 14 and a video conference organized for the union representatives of the group

“Then it's a blackout. […] The management initiated the liquidation procedure without notifying us, and we learned about the liquidation procedure via a leaflet edited by our Italian colleagues, who find themselves in the same hellish situation.”

In fact, French pilots presented a file with various individual employment cases to the Short circuit court and obtained a favorable ruling in December 2020. But liquidators have shown little regard for the French courts decisions, Labor Office warning and Social Committee requests, says SNPL, representing French pilots working for Norwegian. The union sees complete disregard of the ruling and only willingness to liquidate at no cost. Pilots don’t know what and when they will be paid. SNPL, in association with the other Unions and the Company’s Social Council is now calling for a secondary liquidation procedure to run in France in order for the crew to access the payments due by the company. A court ruling is to be expected on May 5th.

Their Italian colleagues are faced with the same situation. Italian crew have been on furlough and welfare payments for months now with the state and taxpayers left to pick up the bill. The KPMG examiners, appointed by the Irish Court, agreed to discuss – and hopefully apply for – the wage guarantee funds for crew as a temporary remedy. But what follows next and what payments will be received is unclear. Equally uncertain is the situation of Spanish crew who were just recently informed that – best case scenario – this year Norwegian will keep two aircraft based in Spain. That means hundreds of jobs more in jeopardy.

At the same time, the CEO makes upbeat statements that the ‘New Norwegian’ will emerge a “stronger, more competitive airline. An airline, which left more than 65% of its crew behind, can hardly be called ‘stronger’.

The business set up that was built to control the costs and shuffle around the risk allowed once again the Norwegian group and its managers, to walk away from their social responsibilities. Where is the money to cover payments to employees in case of insolvency, what protections were in place and if the group shifted assets legitimately is for authorities to investigate. In the current situation, it looks like taxpayers, along with banks, creditors, employees and states would be footing the bill for the spectacular collapse of the grand scheme called Norwegian. The question is whether and if Norwegian’s new leaders will learn a lesson from this and put people first in the “New Norwegian”.

Can a sustainable business be built on the ashes of this one?

In the meantime, the crewing agency OSM and Bjorn Kjos, the mastermind behind Norwegian’s set up and the grand expansion plans, who completely lost control of the airline’s expansion, just announced setting up a new, long-haul low-cost company operating Boeing 787s in… Norway.